|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Personal Bankruptcy Chapter 7: Key Insights and Answers to Common Concerns

Filing for Chapter 7 bankruptcy can be a daunting decision, yet it serves as a vital lifeline for many individuals facing overwhelming debt. This guide explores the intricacies of Chapter 7 bankruptcy, providing clarity on its processes and potential impacts.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' allows individuals to discharge most of their unsecured debts. This process involves the liquidation of non-exempt assets to pay off creditors.

Eligibility Criteria

To qualify for Chapter 7 bankruptcy, individuals must pass the means test, which compares their income to the median income of their state.

- Income must be below the state median.

- Completion of credit counseling is required.

The Filing Process

The process of filing for Chapter 7 bankruptcy involves several key steps:

- Gathering financial documents.

- Completing mandatory credit counseling.

- Submitting a bankruptcy petition and schedules.

The Role of a Trustee

A bankruptcy trustee is appointed to oversee the case, liquidate non-exempt assets, and distribute proceeds to creditors.

Consider consulting denver bankruptcy law firms for professional guidance.

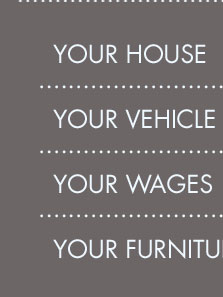

Exemptions and Asset Protection

Exemptions play a critical role in protecting certain assets from liquidation. Common exemptions include:

- Homestead exemptions.

- Personal property exemptions.

- Vehicle exemptions.

State vs. Federal Exemptions

Debtors may choose between state and federal exemption lists, depending on which offers more protection for their specific situation.

Impact on Credit and Future Financial Stability

Filing for Chapter 7 bankruptcy will impact your credit score, but it also provides a clean slate to rebuild financial stability.

Learning how does chapter 13 bankruptcy work might offer alternative solutions for those who do not qualify for Chapter 7.

Rebuilding Credit

Post-bankruptcy, individuals should focus on rebuilding their credit by:

- Obtaining a secured credit card.

- Making timely payments on new debts.

- Regularly monitoring credit reports.

Frequently Asked Questions

Will I lose my home if I file for Chapter 7 bankruptcy?

The possibility of losing your home depends on the amount of equity and the exemption laws in your state. Many states offer a homestead exemption to protect a portion of your home equity.

How long does Chapter 7 bankruptcy remain on my credit report?

A Chapter 7 bankruptcy can remain on your credit report for up to 10 years, but its impact on your credit score decreases over time.

What debts are not dischargeable in Chapter 7 bankruptcy?

Certain debts such as student loans, child support, and recent tax obligations are generally not dischargeable in Chapter 7 bankruptcy.

Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans.

In a chapter 7 case, a discharge is only available to individual debtors, not to partnerships or corporations. Although an individual Cchapter 7 ...

Chapter 7 bankruptcy is a second chance to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, ...

![]()